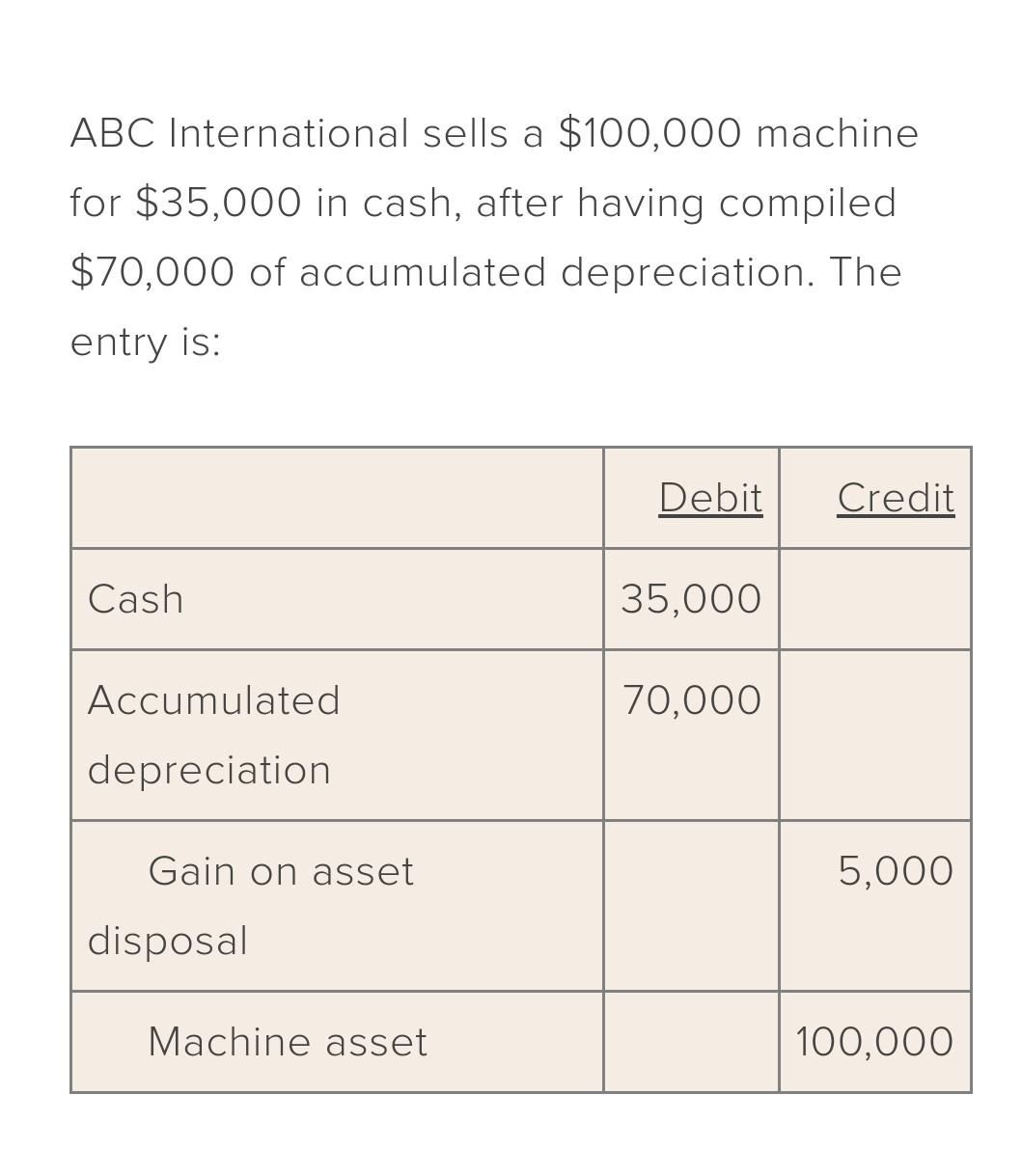

Asset Disposal Journal Entry

Sale of an asset may be done to retire an asset funds generation etc. Click the asset number to open the asset details.

Fixed Asset Accounting Disposal Of Fixed Asset Accounting Corner

Suppose that there is an asset subjected to accumulated depreciation is destroyed by the flood.

. Such a sale may result in a profit or loss for the business. Record the sale or disposal of an asset. In the case of profits a journal entry for profit on sale of fixed assets is booked.

We usually make the disposal of the fixed asset that is fully depreciated by completely discarding it when it has no residual value at the end of its useful life. To use the same example ABC Corporation gives away the machine after eight years when it has not yet depreciated 20000 of the assets original 100000 cost. Solution for Journal entry for asset purchasePrepare a journal entry for the purchase of office supplies on March 9 for 1775 paying 275 cash and the.

5 036 a gain is to be recognized using the following journal entry. Starting from when Ed sends us the invoice this is how we will book the journal entries at each stage in the process. Therefore it represents the difference between that value and the assets carrying value.

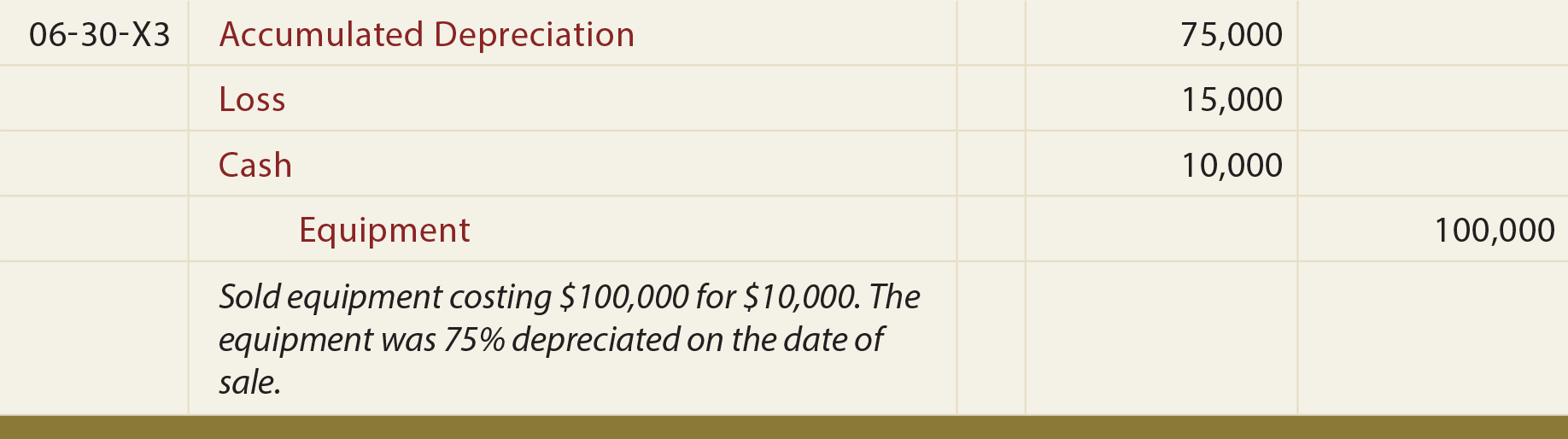

Disposal by Asset Sale with a Loss. Nowadays businesses sell their assets as part of strategic decision-making. If the asset is fully depreciated you can sell it to make a profit or throw give.

A variation on the first situation is to write off a fixed asset that has not yet been completely depreciated. Requirements might include rules for recording acquisition and disposal transactions depreciation lifetimes and write-ups and write-downs of fixed assets. In each case the fixed assets journal entries show the debit and credit account together with a brief narrative.

The cost of the machinery destroyed by the flood was 12000 and it has accumulated depreciation of 6000. I believe I am then supposed to create a current liability account named asset sale deposit to show the 15259 paid by the dealership to close my old loan but I do not know to show the Debits and Credits for this entry or how to close the old loan show the new vehicle and the new loan. 420 Exit or Disposal Cost Obligations 450 Contingencies 450-20 Loss Contingencies 450-30 Gain Contingencies.

Kg or hour that will be used as a reference for unit price entry for fixed assets. Click Options then select Dispose. Asset Accounts Liability Accounts Equity Accounts Revenue Accounts Expense Accounts.

The disposal of assets involves eliminating assets from the accounting records. Sold Machinery fixed Assets book Value Rs 100000 for Rs 90000. There is a common misconception that depreciation is a method of expensing a capitalized asset.

Disposal of an Asset with Zero Book Value and Salvage Value. Journal Entry for Profit on Sale of Fixed Assets. Description of Journal Entry.

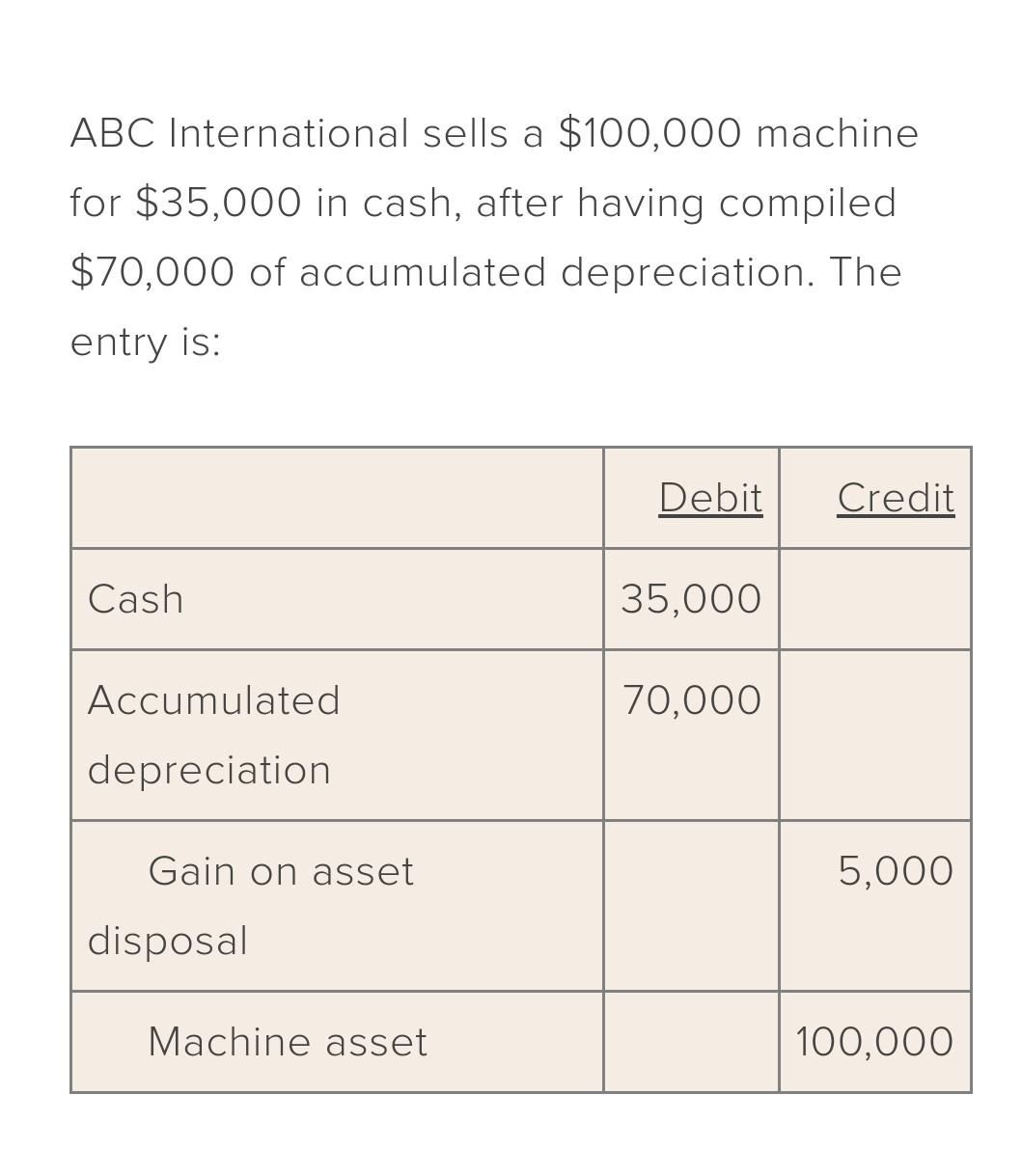

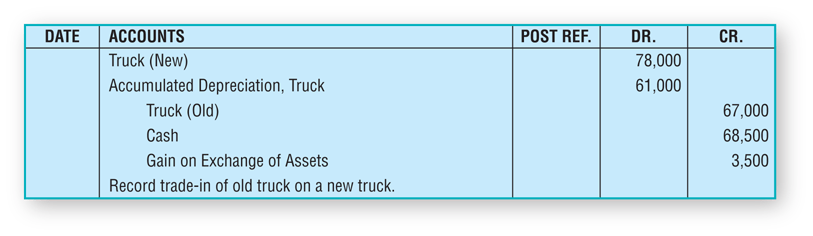

When a fixed asset or plant asset is sold there are several things that must take place. The fixed assets journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of fixed assets. Depending on the value of the asset a company may need to record gain or loss for the reporting period during which the asset is disposed.

Must recognize the gain from the sale. However the insurance company only agreed to pay 5000The journal entry for this transaction will be as. Disposal indicates that the asset will yield no further benefits.

-- Decrease in Assets. Show how the journal entry for the depreciation expense will be recorded at the end of the accounting period on December 31 2018. At the time of disposal of equipment assets account will be credited and accumulated depreciation.

Commonly impairment describes a significant reduction in a fixed assets recoverable value. How is the acquisition cost of property plant and equipment determined. Throwing Giving it away.

When we receive the invoice we need to record the purchase of a fixed asset on the balance sheet. The journal entry for the disposal should be. After the assets useful life is over you might decide to dispose of it by.

Credit GainLoss on Sale of Asset. Where an asset has zero net book value and zero salvage value no gain or loss arises on its disposal. Lets under stand its with example.

In this situation write off the remaining undepreciated amount of the asset to a loss account. Debit cash for 40000 in a new journal entry. Journal Entry for Gain.

Asset disposal is the removal of a long-term asset from the companys accounting records. Journal entry to record the collection of accounts receivable previously written-off. The journal entry you make depends on whether the asset is fully depreciated and whether you sell it for a profit or loss.

Validate your expertise and experience. An insurance claim amounted to 6000 was filed. Enter the details of the disposal.

Select the Registered tab. Journal entry for disposal of asset fully depreciated Fully depreciated asset without residual value. Create fixed asset depreciation book journals.

Cost of the asset. How Do We Book this Journal Entry. Cash balance decreases by 1500.

Accounting for Disposal of Fixed Assets. Read more its expected useful life and its probable salvage value at the time of disposal. Journal entry for loss on sale of Asset.

Take advantage of our CSX cybersecurity certificates to prove your cybersecurity know-how. The initial amount of the lease liability Payments made at or before the commencement date of the lease Lease incentives Initial direct costs Estimated costs for restoration or removaldisposal per IAS 37 Provisions Contingent Liabilities and Contingent Assets. Whether you are in or looking to land an entry-level position an experienced IT practitioner or manager or at the top of your field ISACA offers the credentials to prove you have what it takes to excel in your current and future roles.

IAS 36 defines the recoverable value of an asset as the higher of its fair value fewer costs of disposal and its value in use. If the amount recovered from the sale or disposal of the asset is lower than the carrying amount loss on disposal of asset is recognized. Results of Journal Entry.

The cost of an asset includes all the costs needed to get the asset ready for use. In the Accounting menu select Advanced then click Fixed assets. IFRS 16 directs lessees to calculate the ROU asset as the following.

Asset disposal requires that the asset be removed from the balance sheet. In this case it is simply the removal of such fixed asset from the balance sheet. A debit increases the cash account which is an asset account.

Lets consider the same situation as in scenario 2 but the selling price was only 500. For example assume you sold equipment for 40000.

Disposal Of Fixed Assets Procedure Example

Journal Entries For Retirements And Reinstatements Oracle Assets Help

Disposal Of Pp E Principlesofaccounting Com

Solved I Need A Detailed Step By Step Explanation Of These Chegg Com

0 Response to "Asset Disposal Journal Entry"

Post a Comment